EXW: A TERM TO USE WITH CAUTION

EXW: A TERM TO USE WITH CAUTION

There is a mistaken belief that sales under EXW conditions are the most favourable ones for companies selling in foreign markets as these involve the least effort / risk for the seller.

Nothing could be further from the truth. EXW sales lead to a large number of setbacks and disadvantages in terms of international sales.

There are several reasons that allow us to think that the vast majority of companies that use the term EXW (Incoterms 2010) do so with a troubling ignorance of the peculiarities of this delivery term, incurring totally unnecessary risks and uncertainties.

With EXW “the seller must deliver the goods by putting them at the buyer’s disposal (…) at the designated place of delivery, and not loaded on any collection vehicle”. This means that the seller must inform the buyer regarding the availability of the goods (by email, fax, phone or even WhatsApp). This communication stating that the goods are available is the delivery is the delivery (= fulfilment from the seller), which in turn leads to the right of collection (= obligation of the buyer).

As a result, the goods will be in the seller’s warehouses until they are collected by the buyer, although as we have seen, the goods would have already been delivered to the buyer, and therefore it would be the risk and responsibility of that buyer.

EXW means that “it is up to the buyer (…) to carry out all the customs procedures for the export of goods”. That is, it is the importer who is responsible for the export. Therefore:

-

The buyer must be sure that it can carry out these customs procedures in the foreign country of its supplier. This is far from easy and in many countries it may not even be possible.

-

The seller, who will issue an export invoice without VAT, must have this export perfectly accredited. The single administrative document (SAD) and evidence of the movement of the goods (the transport document) are needed. Yet the single administrative document is managed by the buyer (through its customs agent), and the seller must ensure that it has a copy of the declaration. Without that single administrative document and without the evidence of movement, the file will be incomplete for the tax authorities (naturally in the case of a sale within the single market there would be no need for a single administrative document).

-

The seller should also take into account that the export formalities and declarations are made by the buyer, although the responsibility towards the tax and customs administration would remain with the seller. Any irregularities carried out by the buyer must be assumed by the seller.

-

The seller must adapt its accounting in accordance with the delivery made: it no longer has goods in the warehouse (Stock) but moreover a right to collection (Customers).

-

From that moment onwards, and despite spending time in the seller’s warehouse, the risk of that seller is no longer a risk of damage since it has no insurable interest in a good that has already been delivered to the buyer. Damages insurance must cover the buyer (to whom the responsibility for the goods has been transferred). Has the buyer checked that his insurer would compensate him for damage to the seller’s warehouse (a remote and totally unknown warehouse to the insurer)?

-

The seller has a risk of default from the moment of the communication of availability. This risk is covered by credit insurance and not through damage insurance, since by not having an insurable interest (as a consequence of the delivery) there would be no loss or compensation.

Furthermore, the peculiarities of an EXW delivery should be taken into account when using a letter of credit:

-

As has already been mentioned, the EXW delivery is prior to any transport (in fact EXW is ideal when there is no transport, i.e. when the goods do not move). Therefore, a letter of credit associated with an EXW sale should not require a transport document. If the letter of credit demands it, what would happen is that the seller would have more obligations in the letter of credit than it has in the sale and, as a consequence, the situation may arise in which it would not be able to claim through the letter of credit when it would indeed have the right to collection in accordance with the sales contract.

-

This imbalance between both obligations can also be an inconvenience for the buyer when he does not know that, despite not having paid through the letter of credit, it does have an obligation to pay and a responsibility for the goods.

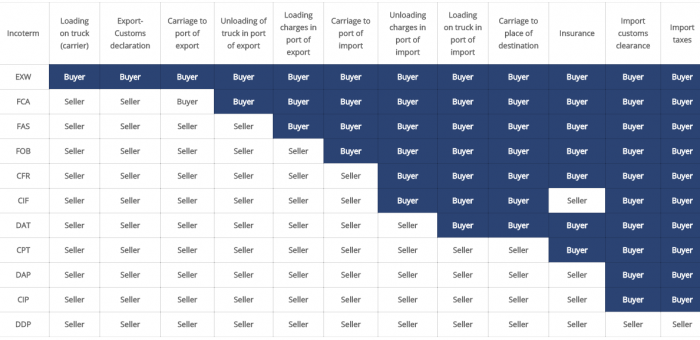

Thus, what would be the most suitable Incoterms 2010 to avoid these circumstances?

The most suitable and similar to EXW would be FCA. With FCA the goods are delivered in the seller’s premises (and this is surely the usual intention of the EXW user), but the delivery will take place to the carrier that the buyer must send us. In other words, the time that the goods are in the warehouse of the seller will remain the responsibility of the seller, and not of the buyer as in EXW.

In addition, export formalities correspond to the exporter, and not to the importer as in EXW. If there is a letter of credit, the existence of a transport document is absolutely coherent. Therefore, FCA is a more “natural” term that easily removes all the drawbacks that we have just outlined.

The terms CPT and CIP could also be a perfectly adequate alternative, in that the delivery would also take place in the premises of the seller in origin, but to a carrier hired by the actual seller (unlike FCA in which the carrier contracts the buyer) without including insurance (CPT) or including it (CIP).

EXW is therefore a difficult term and very frequently used improperly, which leads buyer and seller to incur risks that are both considerable and often overlooked (and thus involve twice the risk).

Fiscal risk, logistic risk, risk of “contamination” of the good, increase of the potential damage on the goods in the warehouse of the seller. While the most unacceptable aspect is a greater increase in competition due to the lack of adding value.

What the seller fails not do, the competition will do, with the potential risk of loss of the client.

Do you need a quote for a specific operation?

ASK US FOR A QUOTE

Comments are closed.